Digital Wallet and Payment Solution

Everything you need to know about Skrill - the digital wallet that specializes in online payments, gambling, forex trading, and international money transfers.

What is Skrill?

Skrill is a digital wallet and online payment system that allows users to make electronic payments and money transfers, especially across international borders. Founded in 2001 as Moneybookers and rebranded to Skrill in 2011, the platform is now part of Paysafe Group, a specialized payments platform.

Skrill specializes in serving industries that are often considered "high-risk" by traditional payment processors, such as online gambling, forex trading, and cryptocurrency exchanges. Its flexibility and global reach have made it particularly popular among users who need to move money across borders quickly and with relatively low fees compared to traditional banking systems.

How Skrill Works

Skrill functions as a digital wallet that allows users to store funds in multiple currencies, send and receive money internationally, and make payments to online merchants. Users can fund their Skrill accounts through various methods including bank transfers, credit/debit cards, and other local payment options.

Setting Up a Skrill Account

Creating a Skrill account is a straightforward process:

- Visit the Skrill website or download the mobile app

- Click "Sign Up" and provide your email address and password

- Verify your email address through the confirmation link

- Complete your profile with personal information

- Verify your identity with government-issued ID (required for higher limits)

- Add a funding method (bank account, card, etc.)

- Start sending, receiving, and spending money

Key Skrill Statistics

- Operates in over 120 countries

- Supports 40+ currencies

- Over 10 million active users worldwide

- Accepts 20+ payment methods for deposits

- Partners with thousands of online merchants

- Processes billions of dollars in transactions annually

Skrill's Core Products and Features

Skrill offers a range of financial services tailored for digital payments:

Digital Wallet

Store funds in multiple currencies and manage your money through web or mobile app.

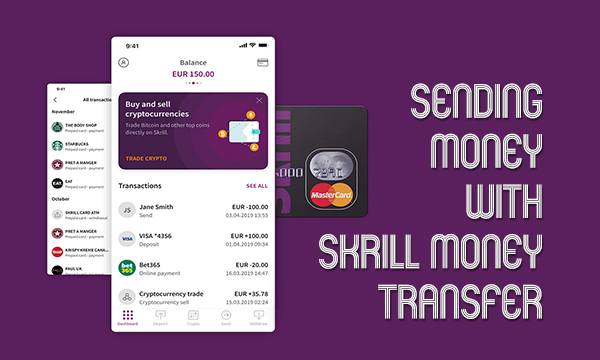

Money Transfer

Send money to other Skrill users instantly and to non-users via email.

Skrill Prepaid Mastercard

Physical and virtual cards to spend your Skrill balance anywhere Mastercard is accepted.

Skrill Knect Loyalty Program

Rewards program that gives you cashback and exclusive offers for using Skrill.

Cryptocurrency Trading

Buy, sell, and hold popular cryptocurrencies directly within your Skrill account.

Merchant Services

Payment processing solutions for online businesses, especially in high-risk industries.

Quick Checkout

One-click payment solution for faster purchases at online merchants.

Mass Payments

For businesses to send multiple payments simultaneously with a single upload.

Payment Methods Supported by Skrill

Skrill supports various payment methods for depositing and withdrawing funds:

Bank Transfers

SEPA transfers (EU), international wire transfers, and local bank transfer options.

Credit/Debit Cards

Visa, Mastercard, Maestro, and other major card networks.

Local Payment Methods

Country-specific options like iDEAL (Netherlands), Giropay (Germany), and others.

Other E-Wallets

Neteller (sister company), PayPal (in some cases), and other digital wallets.

Prepaid Vouchers

Paysafecard and other prepaid voucher systems for anonymous deposits.

Skrill Fees and Pricing

Skrill uses a fee structure that varies based on transaction type and user status:

Standard Account Fees

| Service | Fee | Notes |

|---|---|---|

| Account opening | Free | No cost to create a basic account |

| Monthly maintenance | Free | No monthly fee for active accounts |

| Inactivity fee | €3/£3/$3 per month | After 12 months of inactivity |

| Currency conversion | 3.99% | When sending between different currencies |

| Skrill to Skrill transfers | 1.45% | When sending to other Skrill users |

Deposit and Withdrawal Fees

| Method | Deposit Fee | Withdrawal Fee |

|---|---|---|

| Visa/Mastercard | Up to 2.5% | €5.50/£5.50/$7.50 |

| Bank Transfer | Varies by country | €5.50/£5.50/$7.50 |

| SEPA Transfer | Free or low fee | €2.50 |

| Local Payment Methods | Varies by method | Not applicable |

| Paysafecard | Up to 6.5% | Not applicable |

Pro Tip

To minimize fees, use SEPA transfers for deposits and withdrawals if you're in the European Union, as these typically have the lowest fees. Also, consider upgrading to a Skrill VIP account if you process significant volume, as VIP members enjoy reduced fees and other benefits.

Industries Served by Skrill

Skrill is particularly popular in these industries:

Online Gambling and Betting

Skrill is one of the most widely accepted payment methods at online casinos, sportsbooks, and poker sites worldwide.

Forex and Trading

Many forex brokers and trading platforms accept Skrill for deposits and withdrawals due to its speed and international capabilities.

Cryptocurrency Exchanges

Skrill is integrated with many crypto platforms, allowing users to quickly fund their trading accounts.

Freelancing and Remote Work

Freelancers and remote workers use Skrill to receive payments from international clients.

E-Commerce

Many online retailers, especially those selling digital goods, accept Skrill as a payment method.

.png)

Countries Where Skrill Is Available

Skrill has extensive global coverage with some restrictions:

Fully Supported Countries

Skrill offers full services in most European countries, the United States, Canada, Australia, and many countries in Asia and Latin America.

Restricted Countries

Due to regulatory restrictions, Skrill does not operate in: Iran, North Korea, Syria, Cuba, Sudan, and a few other jurisdictions. Some services may also be limited in certain countries.

Important Consideration

Skrill's services and available features vary significantly by country. Some countries may have restrictions on certain deposit/withdrawal methods or limitations on transaction volumes. Always check Skrill's official website for the most current information about services in your country.

Skrill VIP Program

Skrill offers a tiered VIP program with enhanced benefits:

Silver Tier

Free: Reduced fees, dedicated support, and higher transaction limits

Gold Tier

By invitation: Further reduced fees, personal account manager, and exclusive offers

Diamond Tier

By invitation: Lowest fees, premium support, and custom solutions

Security Features of Skrill

Skrill employs multiple security measures to protect users:

| Security Feature | Description |

|---|---|

| Two-Factor Authentication | Optional 2FA for enhanced login security |

| SSL Encryption | Bank-level encryption for all transactions and data |

| Transaction Monitoring | 24/7 monitoring for suspicious activity |

| Secure Storage | Funds held in segregated accounts at regulated financial institutions |

| Identity Verification | KYC procedures to prevent fraud and money laundering |

Skrill vs. Other Digital Wallets

Skrill compares to other digital payment solutions:

| Feature | Skrill | PayPal | Neteller |

|---|---|---|---|

| Gambling Acceptance | Excellent | Limited | Excellent |

| FX Fees | 3.99% | 4% | 3.99% |

| Cryptocurrency | Supported | Limited | Not supported |

| Global Reach | 120+ countries | 200+ countries | 100+ countries |

| Merchant Fees | Varies | 2.9% + $0.30 | Varies |

Future of Skrill

Skrill continues to evolve with new features and services:

- Expansion of cryptocurrency services

- Enhanced mobile app capabilities

- More local payment method integrations

- Improved rewards and loyalty programs

- Expansion into new markets

- Better integration with sister company Neteller

Final Recommendation

Skrill is an excellent choice for users who need to make international payments, especially for online gambling, forex trading, or cryptocurrency purchases. Its specialization in these areas gives it advantages over more general-purpose payment platforms. While fees can be higher than some alternatives, the convenience, speed, and specialized functionality often justify the costs for users in its target markets. For everyday online shopping or person-to-person transfers, users might want to compare fees with other options like PayPal or traditional bank transfers.

Post a Comment

Post a Comment